Effect of the exchange rate on business

- A depreciation (devaluation) will make exports cheaper and exporting firms will benefit.

- However, firms importing raw materials will face higher costs of imports.

- An appreciation makes exports more expensive and reduces the competitiveness of exporting firms.

- However, at least raw materials (e.g. oil) will be cheaper following an appreciation.

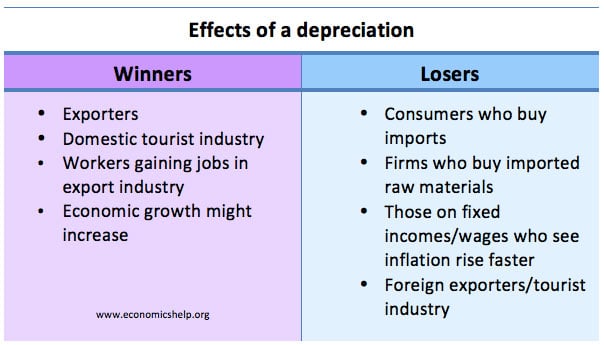

Effect of depreciation in the exchange rate

If there is a depreciation in the value of the Pound, it will make UK exports cheaper, and it will make imports into the UK more expensive.

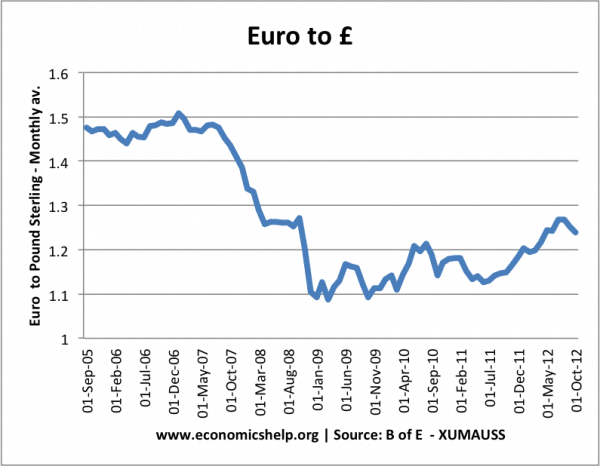

In this example:

- At the start of 2007, the exchange rate was £1 = €1.50.

- By Jan, 2009, the Pound had fallen in value so £1 was now only worth €1.10 (a depreciation of 26%)

Impact on British exporters

Suppose a British car costs £4,000 to build and sells for £5,000 in the UK.

- In 2007, the European price of this car would be €7,500 (5,000 *1.5)

- In 2008, the European price of this car would be €5,500 (5,000 *1.1)

The 26% depreciation means that European consumers now find British goods much cheaper. The cost of producing the car stays the same (assuming parts are not imported), but the effective market price in Europe has fallen. This should increase demand for British goods.

Increase profit margin or reduce the foreign price?

A British firm has a choice, it can reduce the European price from €7,500 to €5,500; this should lead to an increase in the quantity sold, and increase UK exports.

Alternatively, the firm could keep the price at €7,500 and just make a bigger profit margin. It is a good choice for exporters to have – reduce European price and sell more or keep price the same and make a bigger profit margin.

Impact on importers of raw materials

The downside of a depreciation is that British firms who import raw materials will see an increase in the cost of buying raw materials. If the British car company imports engines from Germany to make the car, it will have to pay more to buy the engines. This will reduce its profit margin.

Suppose an engine costs €1000 to import from Germany. In 2007, this costs £666 (1,000/1.5). In 2009, with the fall in the value of the Pound, they will have to spend £909 (1,000/1.1) to buy the same German engine.

Impact on incentives

In the long term, it is argued that a depreciation may reduce the incentives for exports to cut costs. The depreciation enables an ‘easy’ increase in their profit margin. As a result, there may be less incentive to cut costs and boost productivity. If a firm is facing an appreciation, then they may face a greater incentive to cut costs.

Impact of an appreciation on business

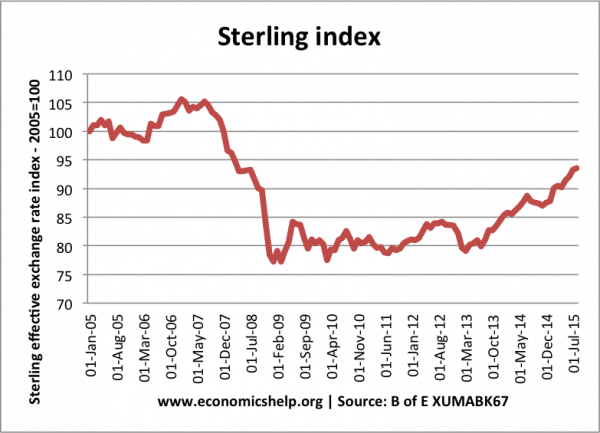

If there is an appreciation in the value of the Pound, e.g. between July 2011 and October 2012 the value of the Pound increased from £1 – €1.1 to £1 = €1.25 The impact will be:

- Exports will be more expensive. This will lead to lower demand for UK exports or firms will have to reduce their profit margin.

- Imports will be cheaper. The import of raw materials will be cheaper.

Evaluation of changes in the exchange rate on business

The effect of the exchange rate on business depends on several factors.

1. Elasticity of demand. If there is a depreciation in the value of the Pound, the impact depends on the elasticity of demand. If UK firms are selling goods which are price inelastic, then the fall in their foreign price will only have a relatively small increase in demand. If exports are price sensitive, then there will be a bigger percentage increase in demand. Evidence suggests that British goods are increasingly price inelastic and after a depreciation, there is a relatively small increase in demand.

2. Economic growth in other countries. In 2009/10, there was a significant depreciation in the value of the Pound. However, the global economy (and EU in particular) was in recession, therefore, demand for UK exports remained weak – despite the lower price.

3. Depends on the percentage of raw materials imported. If a UK firm imports raw materials and sells to the domestic market, it may lose out from a depreciation. If a firm imports only a small percentage of raw materials from abroad and sells to Europe, then it will benefit more from a depreciation.

4. It depends why there was an appreciation/depreciation. If there is an appreciation in the Pound because UK labour productivity is increasing, then firms are likely to be able to absorb the stronger Pound. However, if the Pound rises due to speculation or weakness of other countries (e.g. Euro crisis in 2011) then firms may become uncompetitive because the rise in the value of Pound is not related to increased productivity and competitiveness.

5. Inflation? One possible problem of a depreciation is that it could cause inflation. (for more details see whether depreciation causes inflation) If inflation does result, then firms could face costs, such as greater uncertainty.

6. Fixed contracts. Many business use fixed contracts for buying imported raw materials. This means temporary fluctuations in the exchange rate will have little effect. The price of buying imports will be set for up to 12 or 18 months ahead. Exporters may also use future options to hedge against dramatic movements in the exchange rate. These fixed contracts help to reduce the uncertainty around exchange rate movements and mean there can be time lags between changes in the exchange rate and changing costs for business.

Understanding exchange rates

- Depreciation/devaluation – fall in value of exchange rate – exchange rate becomes weaker (see also: definition of devaluation and depreciation)

- Appreciation – increase in the value of exchange rate – exchange rate becomes stronger.

Example of Pound Sterling depreciating against the Dollar

- £1 used to equal $2.

- Now £1 is only equal to $1.75

What does this Depreciation in the value of the Pound mean?

- Buying goods from America becomes more expensive.

- If a meal cost $10, it used to require £5 (10/2) for a British tourist.

- But, now after the depreciation, the $10 meal will cost £5.71 (10/1.75)

- The depreciation in the pound may discourage British tourists to travel to the US.

- It makes US imports into the UK more expensive, so it may reduce UK imports

- UK exports will become relatively more competitive. It is cheaper for Americans to buy UK goods, so the quantity of exports should increase.

- UK inflation will increase. Imported goods are more expensive (cost push inflation). Also, British goods are more attractive causing a rise in demand (demand pull inflation)

Summary of depreciation

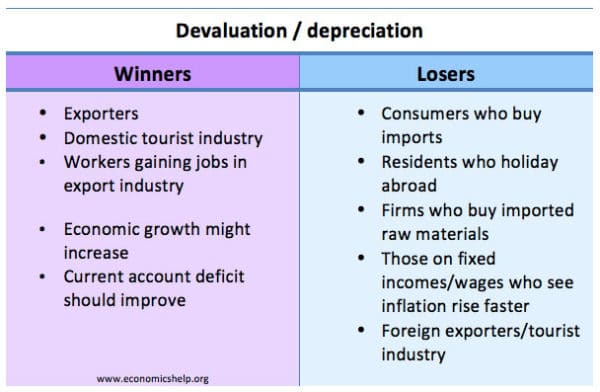

- A depreciation in exchange rate makes exports more competitive and imports more expensive

- A depreciation helps UK exporters and improves UK growth prospects, but causes higher prices and inflation.

Effects of appreciation

The effects of an appreciation in Sterling will lead to the opposite.

- A higher value of sterling makes US imports cheaper for British consumers, but, UK exports become more expensive.

- An appreciation in the exchange rate will tend to reduce aggregate demand (assuming demand is relatively elastic) Because exports will fall and imports increase.

- An appreciation is likely to worsen the current account (assuming Marshall Lerner condition and demand is relatively elastic)

An appreciation is likely to reduce inflation because:

- Import prices are lower

- Fall in aggregate demand

- Firms have more incentives to cut costs.

Is it good or bad to have a devaluation in the exchange rate?

A falling exchange rate can be beneficial if the economy is uncompetitive and stuck in a recession. A devaluation helps to increased demand for exports and create jobs. In a recession, inflation is unlikely to be a problem. However, in a boom, a devaluation could lead to inflation. Also, a devaluation does reduce living standards as imports become more expensive.

An appreciation in the exchange rate is beneficial if it is caused by the economy becoming more productive and competitive. However, if there is an appreciation due to speculation, then it could be harmful as exporters will not be able to compete. E.g. The Swiss intervened to prevent the Swiss France becoming too strong in recent Euro crisis.

See more detail on the effect of exchange rates on business

Factors influencing exchange rates

An exchange rate is determined by the supply and demand for the currency. If there was greater demand for Pound Sterling, it would cause the value to increase. Example: An appreciation in the exchange rate could occur if the UK has:

- Higher interest rates. Higher interest rates make it more attractive to save in the UK, therefore more investors will switch to British banks. Therefore the value of the pound will increase.

- Lower inflation. If British goods become more competitive, there will be greater demand causing the value to increase.

- Current account surplus. A current account surplus means the value of exports (of goods and services) is greater than imports. This demand for UK goods tends to cause stronger exchange rate.

See also: Factors influencing exchange rates

Floating Exchange Rates

A floating exchange rate occurs when the government doesn’t intervene but allows the value of the currency to be determined by market forces.

Fixed Exchange Rate

This occurs when the government intervenes to try and keep the value of the currency at a certain level against other currencies. For example, in 1990, the UK joined the Exchange Rate Mechanism where the value of Pound was supposed to keep within a certain target band against D-Mark.

Currency Manipulation

Some countries are not part of an official exchange rate mechanism, but they may still to try influence their currency. For example, China has sought to keep the value of their currency undervalued by buying US assets. The motive for keeping exchange rate undervalued is that exports become more competitive leading to higher growth. Some argue this intervention is a form of ‘unfair competition’ and it can be termed currency manipulation

Single Currency

The Euro is a bold attempt to replace individual currencies with a single currency. The idea is to eliminate exchange rate fluctuations. However, the Euro has run into several problems. In particular, uncompetitive countries are no longer able to devalue to restore competitiveness.

Comments

Post a Comment